Introduction

Overview

Gini implements the Request-to-Pay (RTP) protocol following and adhering to all of the Single Euro Payments Area (SEPA) established considerations and rules. Gini takes care of your role as Payee’s RTP Service Provider smoothly so that Payees can send and reach Payers, ensuring they get the right message on the right device.

Gini RTP key features:

- SEPA Request-to-Pay compliant

- Easy and fast integration for Android and iOS apps

- ISO 27001 certified

- Data center in Germany

SEPA Request-to-Pay

This documentation will guide you through the integration flow, making it easier and faster to integrate and start making RTP payments on your Store. Through this introduction, we are going to describe the RTP scheme itself, if you are looking for a more technical documentation (or you are already familiar with the RTP scheme), you can go directly to the getting started section

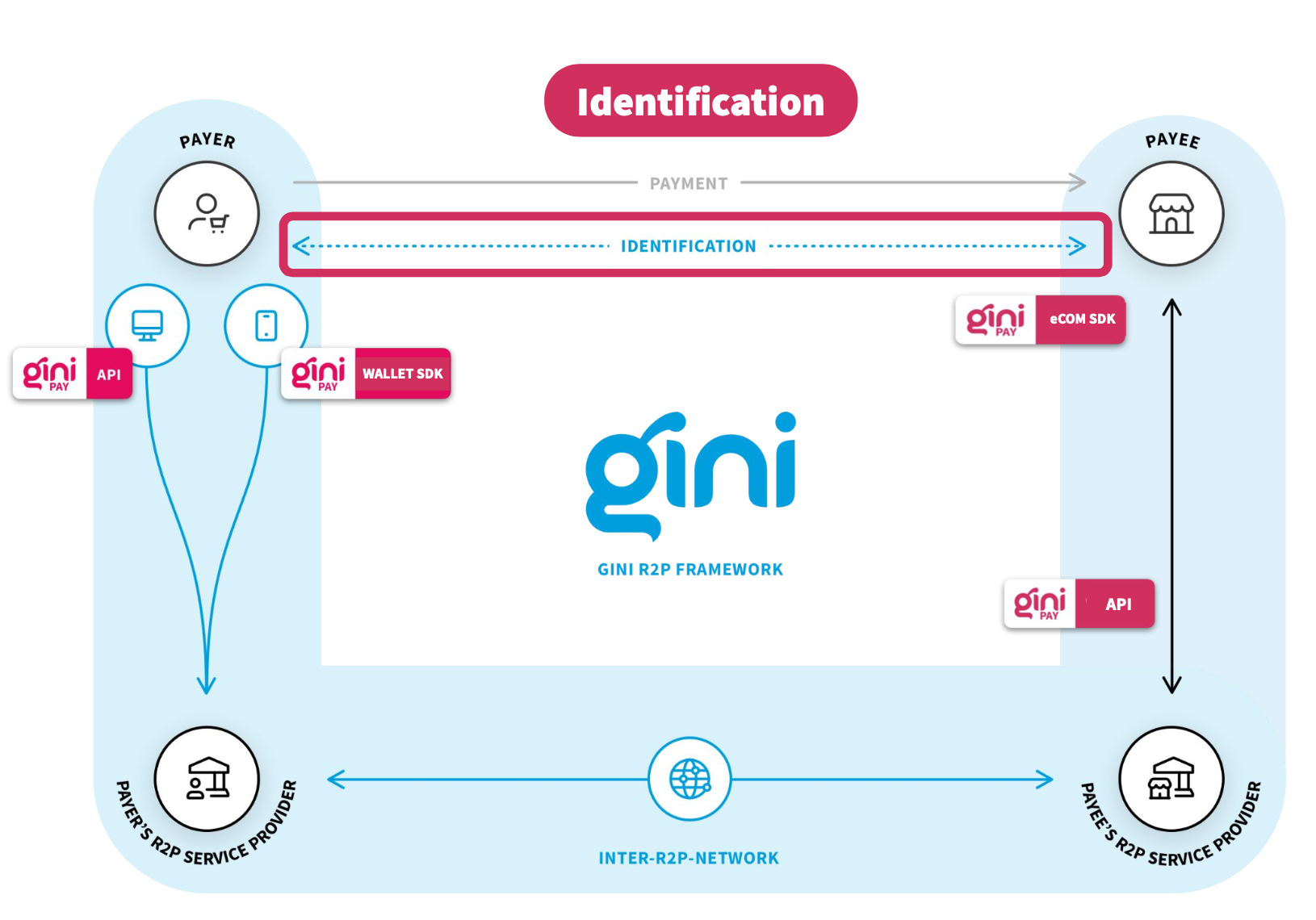

The diagram below illustrates the RTP flows for Gini's 4-corner eco-system. In this model, both Payee and Payer use their own RTP Service Provider, Gini implements both of them, but this documentation will be focused on the Payee side. The Payee can send RTPs to the reachable Payers through routing entities. In any case, the identifier of the Payer and the Payer's RTP Service Provider has to be known by the Payee or the Payee's RTP Service Provider (prior to issuing an RTP request), so that the Payee's RTP Service Provider is able to route the RTP request successfully.

Payer Identification

The identification step is the first step of the flow that needs to be tackled. It allows the Payer and Payee to identify each other before exchanging RTP messages. While an IBAN shared by the Payer would be sufficient, there are more user-friendly ways of solving this requirement. Our Gini Wallet SDK enables four identification methods:

- IBAN-based: Users can manually enter their bank account number (IBAN) at checkout, which is sufficient to route the Request-to-Pay to the right bank. Gini will send the notification to the mobile device the user authorized for this payment purpose.

- App-to-App: In the context of e-commerce in native mobile apps, users can choose to pay with their own bank without sharing any information at the checkout step. Gini's App-to-App functionality redirects users to their preferred bank, where they receive the Request-to-Pay message and accept it with their defined authorization method.

- Web-to-App: In a web context, depending on whether your user is using a mobile or a desktop client, they will follow App-to-App or QR-to-App flow accordingly.

- QR-to-App: In offline payment situations, your users can scan the ad-hoc QR code displayed on a POS Terminal and confirm the transaction with a click. Even the payment receipt can be viewed directly in the mobile app afterwards.

The identification service is not ruled by the SRTP Rulebook.

Here you can find Gini's RTP SDK that provides all the identification services needed depending on your use case.

RTP initialization process

Once the user has been identified by one of the options in the Payer Identification section, the RTP request should be sent to the Gini RTP Service Provider. This request contains all RTP core data, including the Payer’s identifier and all the payments information. After this initial request, a number of immediate internal processes will be triggered and handled by Gini to ensure a straightforward integration. After this, the last step remaining is listening to the response of the payment status. All this is documented in the API section.

Support

Should you have any further questions or encounter any outdated information, please do not hesitate to contact us. We are here to help.

Support: api@gini.net